The perfect pricing model doesn't exist

Do you actually enjoy paying for things? Of course, you don't. That's what makes pricing so hard.

We value different things

There are some things we're happy to pay for. And then there are other things that sometimes we need to buy.

I'll hesitate to pay $8 bucks for the punnet of organic blueberries my 5-year-old drops in the shopping basket. Every. Time. But I’ll happily pay $14 for a pint.

We're all different. What I value is probably different to what you value. Whether it’s consumer goods or software, pricing is hard.

I’m not a pricing expert

I've just had many different experiences working on pricing at some companies you might have heard of.

In 2008, Atlassian had roughly 100 employees and, from memory, was doing about $20M in revenue. In the six years I was there, they had only a single pricing model but consistently increased prices as their products evolved.

In contrast, Intercom was half the size of Atlassian when I joined and had just hit $1M in annual recurring revenue. Five and a half years later, we were doing well over $100M ARR. During that time, I worked on (at least) 4 different pricing models that I can remember.

Lastly, Loom. The product exploded in popularity in 2020 as the world was forced to adapt to new ways of working, and many embraced async video for the first time. Pricing played a big role in Loom's revenue growth during this time. The pricing model changed completely as the product evolved from single-player to multi-player with the introduction of Loom for Teams.

You'll never be done

Across those 13 years, I learned a ton about how to design and communicate pricing changes. As well as what and how to test and iterate in rapidly changing market landscapes.

At the end of the day, there's no silver bullet when it comes to pricing. There are just many things you can and should probably test. Be ready to make trade-offs – whether that’s knowingly leaving money on the table or being OK with fewer customers who pay you more.

Make peace with the fact that your pricing will never be perfect.

So, what is pricing (+ packaging) anyway?

If there's a single piece of advice I'd give anyone working on a pricing project – other than keep the working group as small as possible – it's to align on what you mean when you use certain words. So, pricing and packaging. Two words. Two sides of the same coin.

Let's look at Adobe and Figma as an example. Pre-acquisition, Adobe XD was an alternative to Figma's core product. Same jobs-to-be-done. But vastly different pricing and packaging.

We can't simply say one is better than the other because they're each fueling different strategies.

Pricing is a strategy

If you treat pricing and packaging as a strategy and not just a box you need to tick, it can create step changes in growth for your company. Here are three examples.

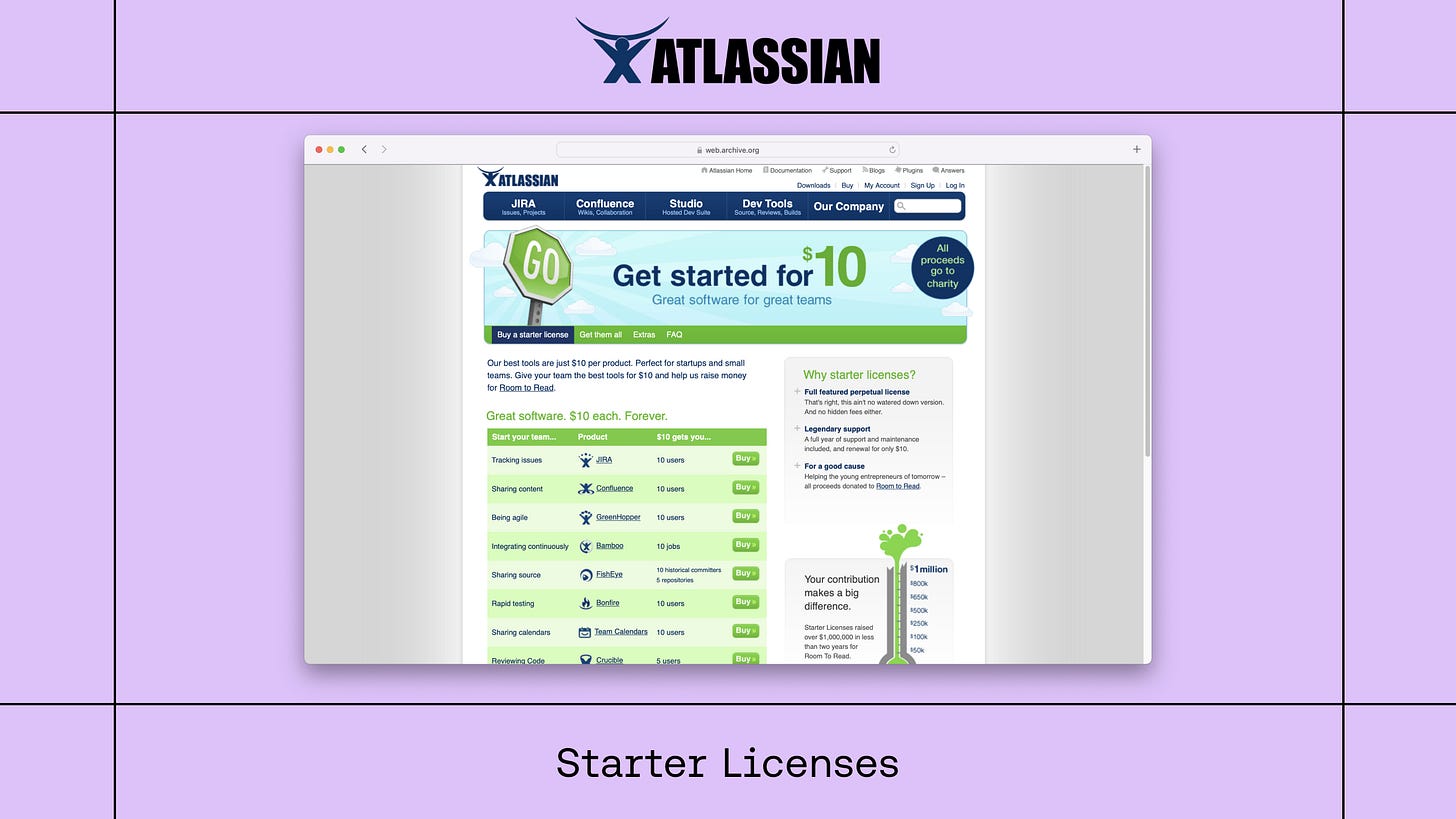

1. Atlassian's "Starter Licenses"

Back in 2009, during the global financial crisis (the GFC), Atlassian introduced Starter licenses – something that had never been seen before in B2B software. At the time, SaaS was in its infancy, and the concept of freemium was non-existent.

Starter licenses provided a ton of value for a one-time cost. You could buy any Atlassian product for ten users for just ten bucks. This program was an absolute game changer for Atlassian’s growth and market penetration at the time.

2. Intercom's "Jobs-to-be-done Packaging"

Intercom evolved from selling multiple tiers of a single product (AKA plans) to rearchitecting the product and its pricing to be sold in a series of "packages".

Each package was based on one of the jobs we’d identified through research that customers were hiring Intercom for. This change was a huge contributor to Intercom’s revenue growth of 1 to 5, then 5 to 20, and then 20 to $60M ARR between 2014 and 2017.

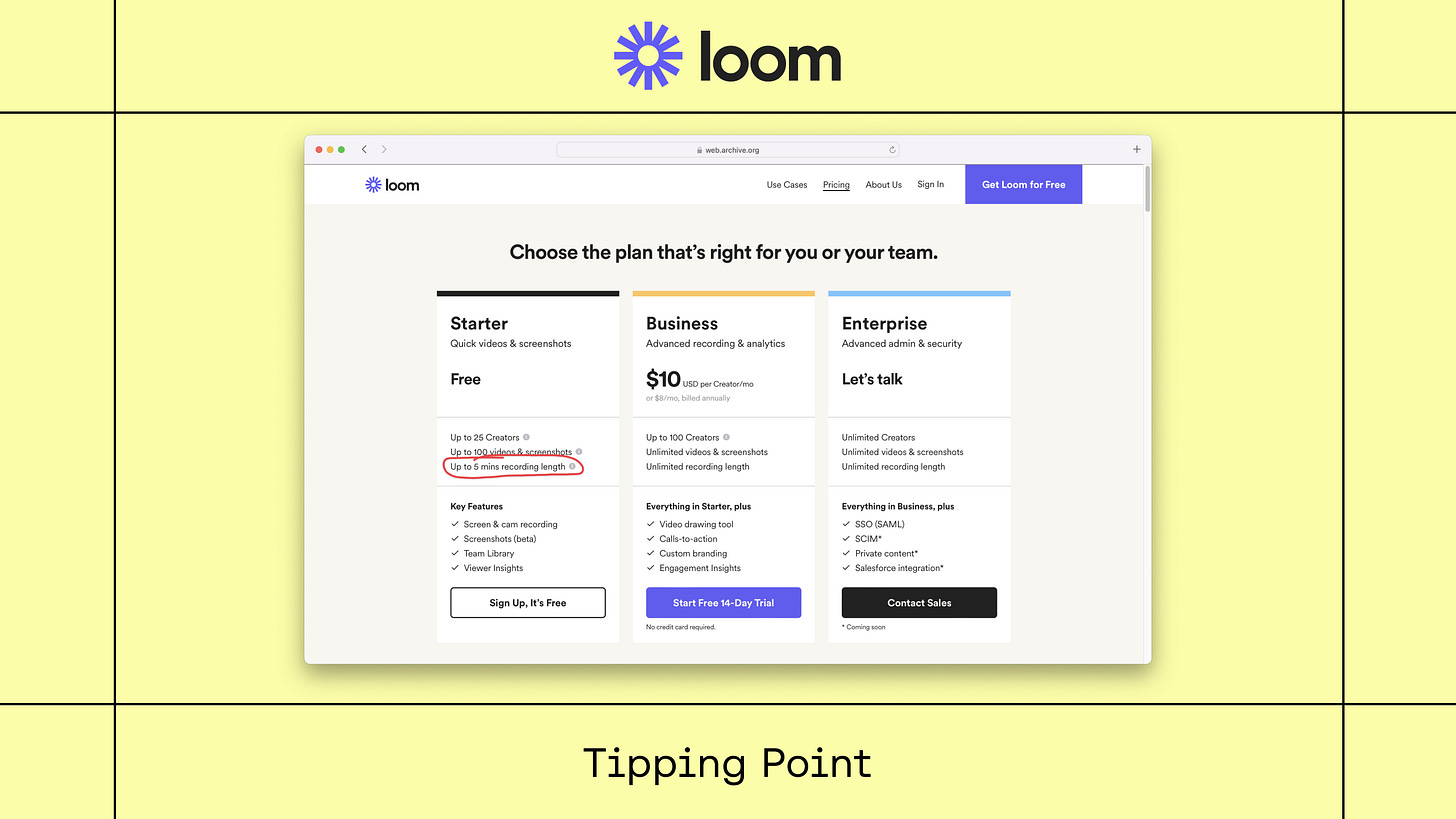

3. Loom's "Tipping Point"

Lastly, at Loom, when we transitioned to multi-player pricing and packaging, we introduced a usage limit on the free plan.

You could have up to 25 creators on the free plan, but those creators were limited to recording videos up to 5 minutes in length. Prior to this, there was no limit.

This one change had a dramatic impact on revenue growth without materially impacting usage. It proved to be a great tipping point for free users and captured a lot of previously untapped willingness to pay.

There are many pricing models

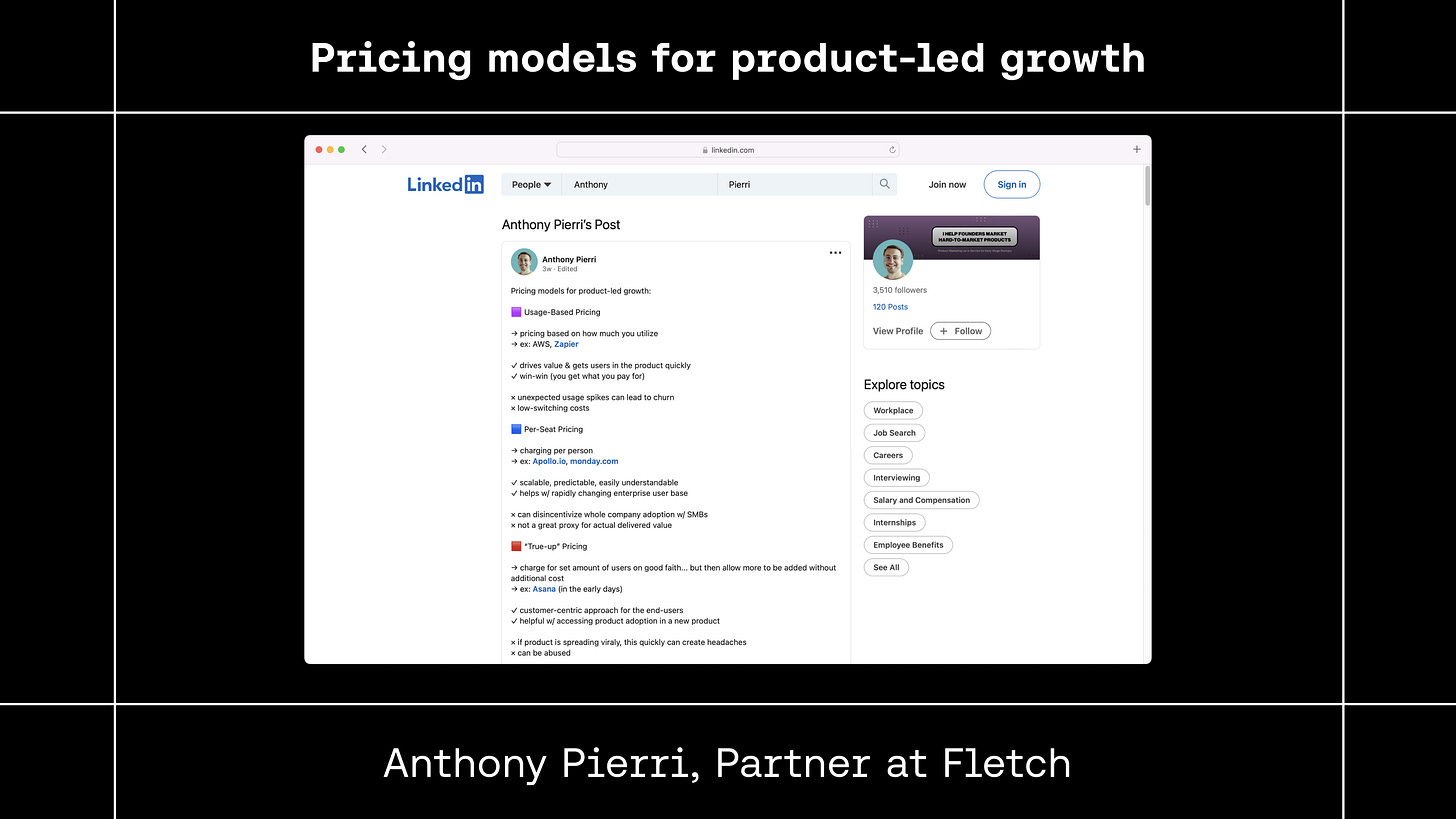

As you can see, there are many different approaches to pricing and packaging your SaaS product. For a good summary, check out Anthony Pierri's post on LinkedIn: Pricing models for product-led growth.

With so many models to choose from, it’s important to remember that they’re not mutually exclusive–or, put another way–you’re not limited to using just one.

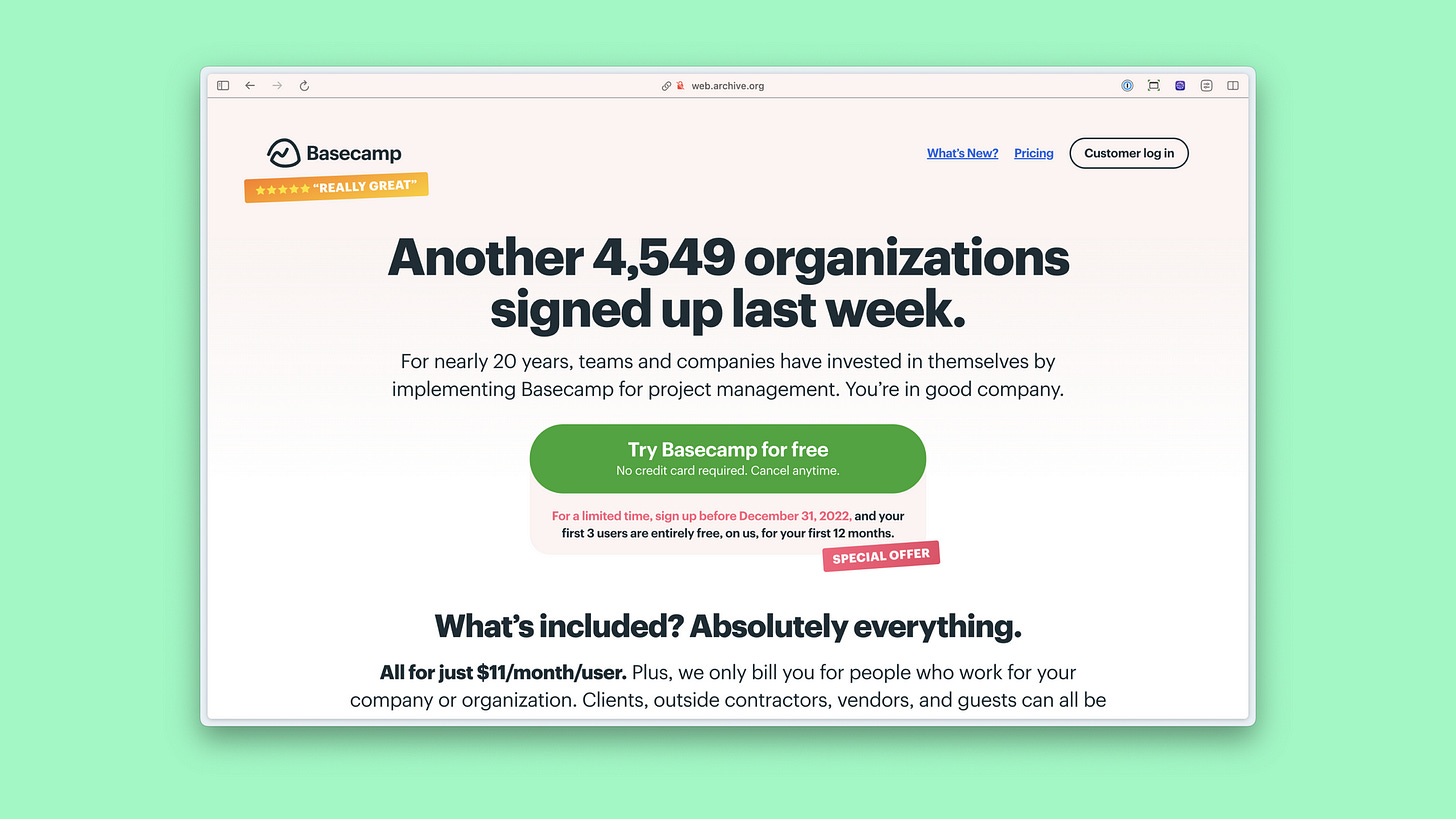

Per-Seat pricing

Take Basecamp, for example – project management software from the team at 37signals.

Historically, their pricing model has been super simple. There was just one thing to buy and one thing that impacted how much you paid – the number of people at your company that use the product.

Per -Seat pricing is extremely common. And for good reason. It's easy for customers to understand, it’s predictable, and it’s within their control.

These are all things that customers love when it comes to pricing. And while that's great for customers and for the business, it does mean that expansion opportunities are limited to the size of your customer base.

It’s one-dimensional. If they don’t grow, you don’t grow. Your only other path to revenue growth is to bring more customers in the front door.

+ Tier-based pricing

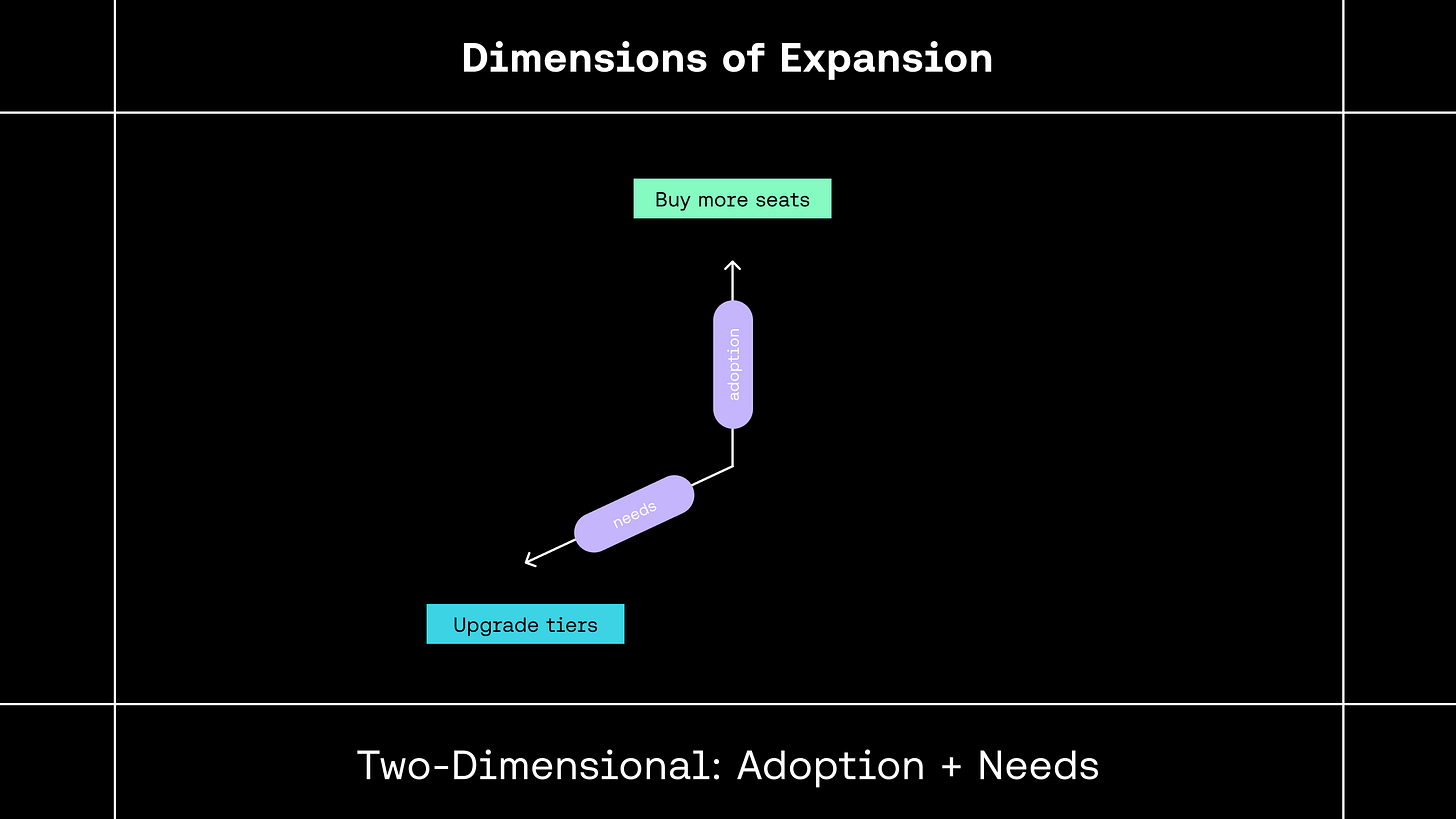

That’s why combining Per-Seat and Tier-based pricing is more common. This is what many B2B SaaS products, like Linear, do.

It's still simple – you pick the plan that suits your needs (that’s the tier), and you pay for each user that uses the product (the seats).

With this approach, not only do you monetise as your product is adopted by more people in a company, but you monetize as their needs grow and, as a result, upgrade to a higher tier.

By combining models, you now have two dimensions of expansion versus one.

+ Usage-based pricing

Lastly, it’s not uncommon to combine Per-Seat and Tier-based pricing with Usage-based pricing. This is what Intercom currently do.

In addition to the number of seats and tier you need, you pay for the number of people you message through Intercom each month. The more you use the product, the more people you will likely message.

This provides a third dimension of expansion for Intercom.

Even if a company doesn’t grow and its needs remain the same, they’ll pay more if they use the product more.

While combining multiple models can benefit the business, it does come with added complexity for customers, which can cause confusion and result in customers buying the wrong thing or, worse, not buying at all.

Remember when I said there are trade-offs in pricing? This is a big one.

So, what model should you adopt?

That all depends on your pricing strategy. But that's a topic for another post.

Happy pricing (and packaging).