Benchmarking Annual Recurring Revenue

Truth be told, I hate benchmarks. They do have value. Just use them wisely.

This post is an adaptation of Chapter 7 of our book, The Ultimate Guide to ARR.

Join thousands of founders and finance professionals from Uber, Atlassian, Plaid, Retool, Intercom, and more, and get your free copy today.

Truth be told, I hate benchmarks.

In the early Intercom days, we would always get dinged for our churn. We’d always have to spend time carefully crafting our story on churn when we went out to fundraise. It was the reason many passed. And it constantly came up in board meetings.

Here’s the thing, though. Whenever it came up, it was in reference to the performance of other businesses. But most other SaaS businesses at the time were very different from Intercom.

In 2013, the only notable public SaaS companies were Salesforce and Workday, and most private SaaS companies of any meaningful scale were companies similar to them—enterprise companies. Intercom was different. We were part of a new generation of SaaS companies. One that sold primarily to other startups. Smaller contracts, monthly payments, and self-serve purchases. That might be commonplace now, but it wasn’t then.

That’s why benchmarks simply didn’t apply to us. It wasn’t fair to hold us to retention rates similar to a Salesforce and certainly not a Workday. The cost of acquiring customers for those companies is way higher, so they need to have meaningfully different retention dynamics. Customers came to Intercom essentially for free. We could churn them at a much higher rate and still have a beautiful business. I share this as a cautionary tale before you read this chapter.

Be careful what benchmarks you use and who you compare your business against. Every business is different. A subscription prosumer business is different from a bottoms-up low ACV business, which is different from an enterprise business with a much higher ACV and fewer customers. Even within those categories, businesses can look meaningfully different. And, of course, the stage of business matters, too! A seed-stage business can and will have different growth, retention, and acquisition dynamics from those at scale. Seems obvious and makes sense, but often, benchmarks just get tossed around as a stick to beat you with. Don’t let that happen.

Your startup is bringing something new to the world. That’s what it means to be a startup. And that newness can mean that existing benchmarks either don’t apply or they need to be meaningfully discounted in value.

Let this serve as a gentle reminder that what’s far more pragmatic is treating benchmarks as a reference. You need to take the time to deeply understand the dynamics of your business and articulate what’s working and what's not. You must define what’s a good or bad metric in relation to where you want to go, which will not always be where others have been. Sometimes you just have to chart your own course.

Growth benchmarks

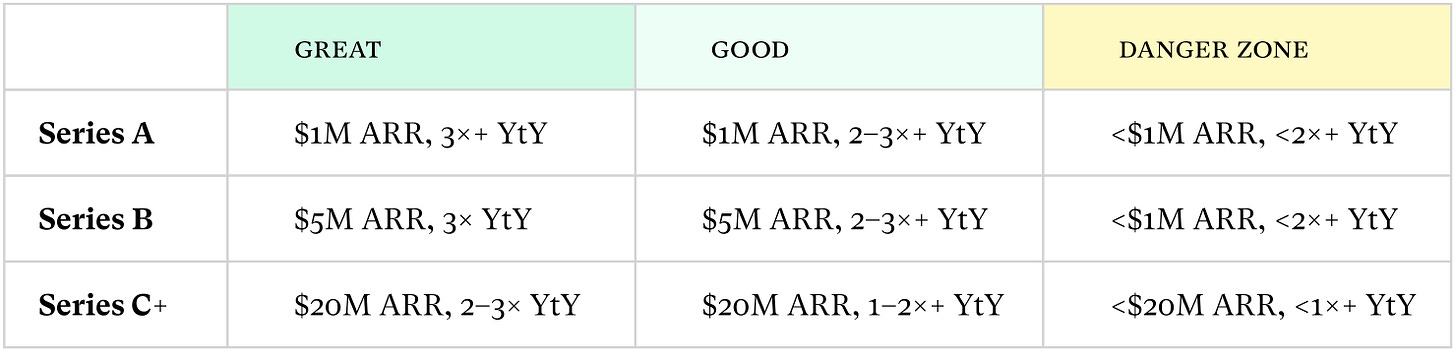

A simple place to start is to consider ARR thresholds and growth rates for different-stage companies. These are by no means hard and fast rules. You can raise venture rounds at meaningfully different benchmarks from this. Other factors that get weighed heavily at different stages include the strength of the team, the complexity of the product, TAM, product engagement and usage, and other metrics. To give you an example, an investor might bet on a product that has incredibly high adoption and usage metrics but that has not yet matured its go-to-market motion in the belief that high product usage indicates a fantastic fit with users, but the startup has not yet nailed how to sell its product.

Retention benchmarks

Retention is one of the trickiest things to benchmark–queue the story from Intercom. It meaningfully depends on the type of recurring revenue business, but also the stage of the company and maturity of the business. It’s common that as a business scales, much of its cohorts are more mature, meaning they churn less frequently but also potentially expand less. There are many forces pulling retention in different directions. For example, an early-stage company might have lower retention because they are selling to smaller companies. Or because their offering is less mature. Or because their cohorts are all earlier in their lifecycle.

However, they might also have higher retention because expansion often occurs earlier in a customer’s lifecycle.

Finally, retention is a very mixed bag in how it’s calculated. To give you a feel for this, Keybanc has a 40-page deck that helps define how each public company calculates retention. They’re all different. Here’s a snippet from it:

That said, we want to share probably the most helpful resource we’ve found to help you calibrate whether your retention is Good or Great. Anything worse than that, you’re in the Danger Zone again. These NRR benchmarks come from Lenny’s Newsletter, and what we like so much about it is that it breaks things down according to the type of SaaS business you run.

For ARR, those are the benchmarks we trust the most. To reiterate, the most important message we can leave you about benchmarks is to use them wisely. Never let benchmarks drive how you run your business. Always ensure you do that from first-principles thinking and your own understanding of your unique business.