Building and taking a horizontal product to market is hard

We were warned. When it all got too dizzying, we went vertical. And it's working.

There are varying degrees of what it means to be horizontal. Horizontal-ness, so to speak, refers to the number of use cases and buyers a product spans. The more use cases and buyers, the more horizontal.

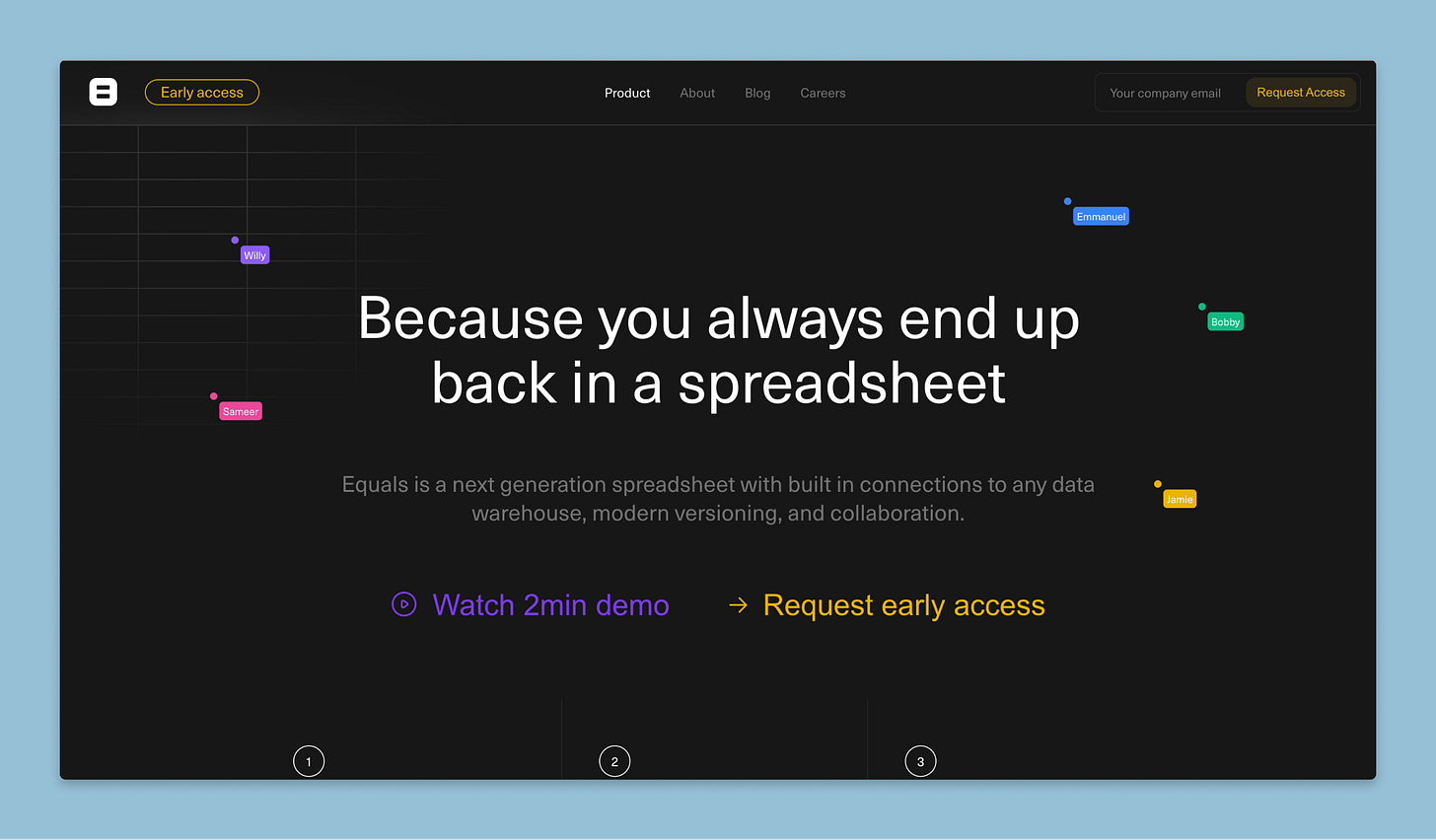

Equals, the next-generation spreadsheet, is about as horizontal as it gets. Consider who uses a spreadsheet and for what. The combinations are infinite.

From the moment I put together the first Equals pitch deck, nearly everyone told us how hard it would be to build and take to a horizontal product to market.

We were warned.

“Makes sense. But we’re different.” So I believed.

Turns out this was a lesson I’d have to live.

Thus began a multi-year journey to internalize what it means to be horizontal vs. vertical, understand the implicit tradeoffs, and grapple with the challenges of bringing a horizontal product (and our massive vision) to market.

In the hopes of helping other founders grappling with the same question, here’s our journey.

The allure of being horizontal is real

We set out to build Equals in early 2021. Our vision was (and remains) to build the next spreadsheet. Born from a frustration with BI tools, data notebooks, and the wide range of out-of-the-box reporting solutions, our first launch struck a chord.

Our pitch and initial wedge into customers: We’re a spreadsheet natively connected to data—the only spreadsheet connected to SQL and the most commonly used SaaS tools for automating analysis.

We started to onboard customers and tried various go-to-market motions. As we talked to folks, it became clear that people loved the premise of Equals. They just wanted more of it.

But they became the confusing part. Who were they?

When you tell people you’ve got the next-generation spreadsheet connected to data, that means many different things to many different people.

On any given day…

…we’d talk to a head of product who loved the idea for Equals… if only our Mixpanel and Amplitude connector were a little deeper. Oh, and maybe make the spreadsheet less spreadsheet-y.

…we’d talk to a head of finance at a startup who sometimes knew SQL and loved the spreadsheet. “But for this to really work, I’ll need a Netsuite connector.” And they’d also ask for more parity with Excel.

…we’d talk to a Shopify business owner running their entire business out of spreadsheets. Could our Shopify integration put their reporting on auto-pilot? How about templates?

…we’d talk to a sales ops person complaining about HubSpot or Salesforce reporting. “I could definitely see myself building sales funnels, or attainment reports, or customer health dashboards.”

…we’d talk to an owner at a demand generation agency. Our Google Analytics plus Facebook Ads plus Google Ads connector would seemingly automate their client reporting.

…we’d talk to a founder who viewed all of our connectors as an alternative to buying a data warehouse, an ETL tool, and hiring a data engineer. We could save them hundreds of thousands of dollars!

…we’d talk to a head of engineering. Their customers would love Equals. “Could we white-label it and embed it into our product?”

…we’d talk to a BI leader at a public company. Surely, we can help with their self-service analytics initiative.

And then there was a very long tail of others: managers of cleaning companies, principals of school districts, managers at pet resorts, DJs at radio stations. They all use spreadsheets. Can we automate them??

Dizzying.

At the same time, we were eager and hungry to grow, show traction, and get our foot in the door with as many businesses as possible. “Do things that don’t scale!” right? 😅

So we dove deep into all sorts of connectors—we built some wild ones that I’d never tell you about :). We also presented all sorts of analyses for folks, all in the spirit of getting traction, growth, and learning.

But it became wholly confusing and wholly unscalable.

How we sell Equals came to a head. Every deal had a slightly different buyer, at a slightly different stage company, with a slightly different use case. The bespoke nature of every deal meant they went closed-won seemingly randomly. Growth was unpredictable. Our pipeline reviews were an array of discussions—each deal ran completely differently, and each path to purchasing was different.

In this dizziness, we finally realized we had to do something different.

Everything became clear once we verticalized

As I tell you where we are now, it’s tempting to think we should have started here. But that’s not how startups work. Everything we went through above, we had to go through. We had to talk to a dizzying array of leads. We had to onboard wholly unscalable customers. We had to feel the pain of what wouldn’t work in order to find what seems like it just might.

So, as it dawned on us that we could no longer sell to and onboard such a wide variety of customers - not to mention acquire them all at scale - we started to look through our customer base and find the use cases where Equals worked best.

One stood out.

We had onboarded the finance team at Descript.

They came to us looking for help with some of their core ARR and SaaS metrics reporting. Chris and I knew this problem deeply. We’d lived it at Intercom. We’d made all the mistakes (sounds like a pattern, right?) to land a powerful reporting solution there. So, we built Descript exactly what built done at Intercom—from data transformation to templates—and they loved it.

As we evaluated all the different use cases we’d covered so far with Equals, this felt the most compelling for several reasons. Equals the product was uniquely positioned to be a 10x better solution relative to anything in the market - ARR and SaaS metrics reporting requires flexibility. Plus, Chris and I could leverage our reputations and deep subject matter expertise to help market the solution.

We turned around and offered the same but tailored ARR reporting solution to a few of our other customers. It turned out they wanted the same thing, and once they got it, they also loved it. And so, from here, we decided to make “ARR Reporting” a focus. Below is a slide from our Board deck in Q1 of this year, sharing our shift in focus from a horizontal go-to-market to a vertical one.

Yet, we didn’t feel confident enough to bet the homepage (our most important piece of real estate) on this solution. So, we put up a landing page to showcase why you should use Equals for ARR reporting.

Then, we wrote a book, The Ultimate Guide to ARR, to build awareness, cement our position as subject matter experts, and generate leads (of course).

More than a thousand downloads later, we made the use case way more prominent. We rearchitected the website, making use cases the first item in the primary navigation and the first section on the homepage below the fold. It’s the main message you see when you visit our site. You can’t miss it.

Focus on doing one thing really well

I suppose this is what it means to verticalize. We’ve reduced and honed in on the use cases we know we can sell, actively turning away folks we no longer want to sell to. Now, we only talk to those we know can serve excellently.

That might sound crazy, but it’s not. I can now, with complete confidence, tell you that Equals is (at least) 10x better than anything in the market for venture-backed SaaS companies with $0.5M-$50M ARR who use Stripe, Hubspot, or Salesforce. If you’re a Head of Finance or Founder at one, we should talk.

As we’ve (re)focused, we’ve seen growth accelerate and become more predictable. When a lead comes in looking to do ARR reporting, the sales team knows exactly how to run the process, I know we’re going to win it, and I know the customer will have an excellent onboarding.

We’re no longer dizzy. What to do next is crystal clear.

Land first, then expand

On reflection, going vertical feels a bit counter to the nature of a founder. We’re commended for having as big and grand a vision as possible. Verticalizing, in some ways, feels like giving up a part of that vision. Yet most things in life are paradoxical. The bigger the vision, perhaps the smaller the first step needs to be.

The strategy now is to build the business use case by use case. We’ll continue to nail and land customers for our ARR reporting and SaaS metrics use case. We’re already seeing those customers pull us into new use cases. Sales funnel reporting with Hubspot and Salesforce is the next obvious one. As we continue to build and land with the best reporting solution for SaaS companies, we can expand beyond SaaS.

The beauty of Equals is that we still have a horizontal product as the company's foundation. It’s a tool, a spreadsheet, with all the primitives necessary to build world-class reporting for any business. The breadth of folks coming to us in the early days is a strong signal of the opportunity ahead of us; we’ll be taking it one step at a time.