SaaS metrics for fundraising

Fundraising is chaotic. The fates of companies and investors alike are decided in these moments. It’s high pressure. It's intense. Let's prepare you for it.

I hate to say it, but when it comes to fundraising, there’s a lot you cannot control.

You don’t know which investor might fall in love with you as a founder, your product, or your vision. And you certainly don’t know what games or pressure they may apply through the courting and negotiation process. Trust me, they play them.

That said, one thing you can control is having your metrics in order before you start the process. That means being clear on the metrics that matter in your business. It also means anticipating the questions investors might ask and requests they may make. The more you prepare and the more you foresee, the less you leave to be open to interpretation.

This guide will help you get your metrics in order so you can embrace the chaos.

We all know the pitch deck. The fundraising process revolves around it. Movies, sitcoms, and full-blown TV shows have been made on them. And there are countless courses and blog posts on how to build the perfect one. "Build a great pitch deck, and you’ll raise millions”. So, they say.

But have you heard of the data deck? Probably not, yet it’s the single most powerful thing I’ve built for every single fundraising process I’ve led—Intercom’s $23M Series B, $35M Series C, $120M Series D, and Equals’ $16M Series A.

The data deck is simple. It’s the story of your business, told purely through data. Its intention is to ward off any question, fear, or doubt an investor may have about any metric in your business.

I can’t tell you how to build it for your business. Because that depends on your company, how you acquire, bill, retain, activate, and engage users, how you spend money, the market you’re in, etc.

What I can tell you is what investors care about and like to see. This should help you create a data deck that anticipates their questions and tells your story such that they never get asked. It should give them confidence in their decision and help them convince their partnership to write the check.

So, what do investors care about when it comes to SaaS metrics?

Revenue

While every other type of business is valued on earnings, SaaS companies are valued on revenue multiples. So, painting a really clear picture of your ARR growth is the most critical thing you can do.

When an investor makes an investment, they’re doing the math on what return they think they can achieve. Because of the structure of venture, they’re looking for investments that can return multiples of their original investment. Those multiples get bigger in the earlier stage of the investment. Roughly speaking, Seed and Series A investors are looking to return 10x on their money. Series B and C investors in the 5-7x range. Series D+ are in the ~2-3x return range. Again, these are rough ballparks.

When it comes to telling the story of your revenue, your job is to convince investors that there’s a clear and credible path to getting to ‘x’ return. For example, if you’re a $1M ARR company looking to raise a Series A, and you’re looking to raise at a $100M post-money valuation, you need to convince investors that you can become a $1B company (10x $100M), or roughly speaking get to $100M ARR (assuming revenue multiples are ~10x).

In building that case, the most critical part of your model is the ARR build. An ARR build is broken down into five component parts: Gross New, Expansion, Contraction, Churn, and Restarts. Each of those component parts showcases a different part of your business. Gross new is an indicator of how well you acquire and monetize new users. Expansion showcases how quickly those users adopt your product more deeply or buy additional products if you have multiple. Contraction and churn show the relative drop off of usage or outright issues with your product. If you need help on the topic of ARR, don't worry; we’ve written a whole book on it.

When it comes to recurring revenue, your job is to lay out how your current ARR build will become the build of the business you are asking an investor to pay for. This story is often told through the following categories.

Acquisition

This is essentially how new ARR comes to be, and it’s critical. It’s the story of your Marketing and Sales efforts. The most important thing you need to spell out for investors is how efficient you are at acquiring new customers. The ultimate measure of this is your Customer Acquisition Cost (CAC) relative to the Lifetime Value (LTV) of a customer.

But you’ll need to get more specific than just showing your LTV:CAC ratio. Investors will care about the Payback Period - how long it takes you to recoup your acquisition costs for any given customer. The lower the payback period, the faster you’ll be able to reinvest back into the business and, therefore, the faster you’ll be able to grow.

Ponder this simple thought experiment: two businesses with the exact same LTV:CAC ratio can have very meaningfully different outcomes depending on their payback period. A business with a faster payback period will be able to reinvest back into growth much faster, compounding more quickly over time.

All of this needs to be considered holistically. Whether you’re a self-serve business with no sales costs or a business with a massive sales team, all costs need to be factored into your LTV, CAC, and Payback Period.

Retention

I had an investor describe retention once as the ‘event horizon’ for any SaaS business. If you’re not a space nerd, an ‘event horizon’ refers to the point on the surface of a black hole where the velocity needed to escape it exceeds the speed of light. Because nothing can exceed the speed of light, the event horizon is the point at which no light can escape. It all collapses into the black hole.

The point is that your ability to grow your business depends on retention. If retention is poor, there’s no escaping it. You’ll never outgrow it, and your business will collapse into a black hole. That’s how seriously investors take retention.

Whenever I’ve shared retention, I’ve had to do so across three specific metrics:

Net Revenue Retention, which shows the total spend of a group of customers relative to a prior period. It’s net of everything, upsells, downsells, churn.

Logo retention, which shows the percentage of customers who remain customers relative to a prior period.

Gross Revenue Retention, which shows the spend of a group of customers relative to a prior period, excluding expansion and contraction. Think of it as a dollar-weighted way of looking at logo retention.

We look at all these metrics on an annual basis, i.e., over a 12-month period. But we almost always break things out on a cohorted basis to showcase how retention has trended over time, across cohorts.'

Engagement

Over time, a company is primarily valued on its financial metrics. However, the most savvy investors I’ve encountered know that financial metrics are often a lagging indicator. One of the best early indicators of a company's promise and impending rise is product engagement.

Product engagement is probably the hardest thing to crack for any SaaS company. It’s so damn hard to get people to change – to adopt new tools and new ways of working. If you can demonstrate that you’ve not only done that but you’ve done so in a deep way, that’s a very strong indicator that your company will be successful in the long term. It’s a sign that it’s only a matter of time before the financial metrics catch up.

The inverse is true. A company growing really quickly from a financial perspective that has poor product engagement is a dangerous investment. If users aren’t deeply engaged with the product, it’s the first thing customers will drop when the market turns, or a new solution emerges.

Investors typically look at metrics like Monthly, Weekly, and Daily Active Users (MAU, WAU, and DAU). We recommend also looking at things like how many users are active in your product 3 out of 7 days a week – what we call A3x7. It’s a high bar for engagement in the B2B SaaS world.

Financials

No investor packet would be complete without a financial model. For most SaaS companies, you don’t need a full three-statement model. In fact, I’ve never built one. Instead, an operating model that shows the key levers in your business and the key levers that impact cash is what really matters. Build a really crisp income statement model that’s connected to your Annual Recurring Revenue (ARR) model, showing where you’re going to invest capital—be it marketing discretionary spend, R&D headcount, or something else. The goal of the financial model is to articulate the shape your business will take over the coming years.

You want to show that your Gross Margin (Revenue minus Cost of Revenue) scales nicely—meaning you make more money for every dollar of revenue you bring in over time. You’re considerate about your expenses, giving yourself ample time to raise future capital in a meaningful step up or get to cash flow positive as a business.

Across all of your metrics, cross-cutting by the dimensions that most significantly drive differences across your business is critical. For some, that means cutting by company size—early-stage businesses buy and retain software differently than enterprises. For others, it might mean cross-cutting by industries—you might sell to other technology companies, dentists, or anything in between. You may find that geographical differences are meaningful—perhaps you serve US markets really well, but your European presence is nascent or just emerging. Whatever cross-cuts in your business are most meaningful and represent break points in how your business works, get ahead of them. Show them. Share an explanation for why they’re different and how you intend them to look over time.

Investors are pattern matchers

While every business is different, an investor’s job is to look across all businesses and pick out the ones most poised to break out. They typically do that by studying those that have previously broken out and applying that knowledge to emerging companies.

That’s why it’s useful to frame as many of your metrics as possible and tell those stories through a lens of how others have done it before. This helps bridge the mental gap for an investor who may struggle to see how your business comes together.

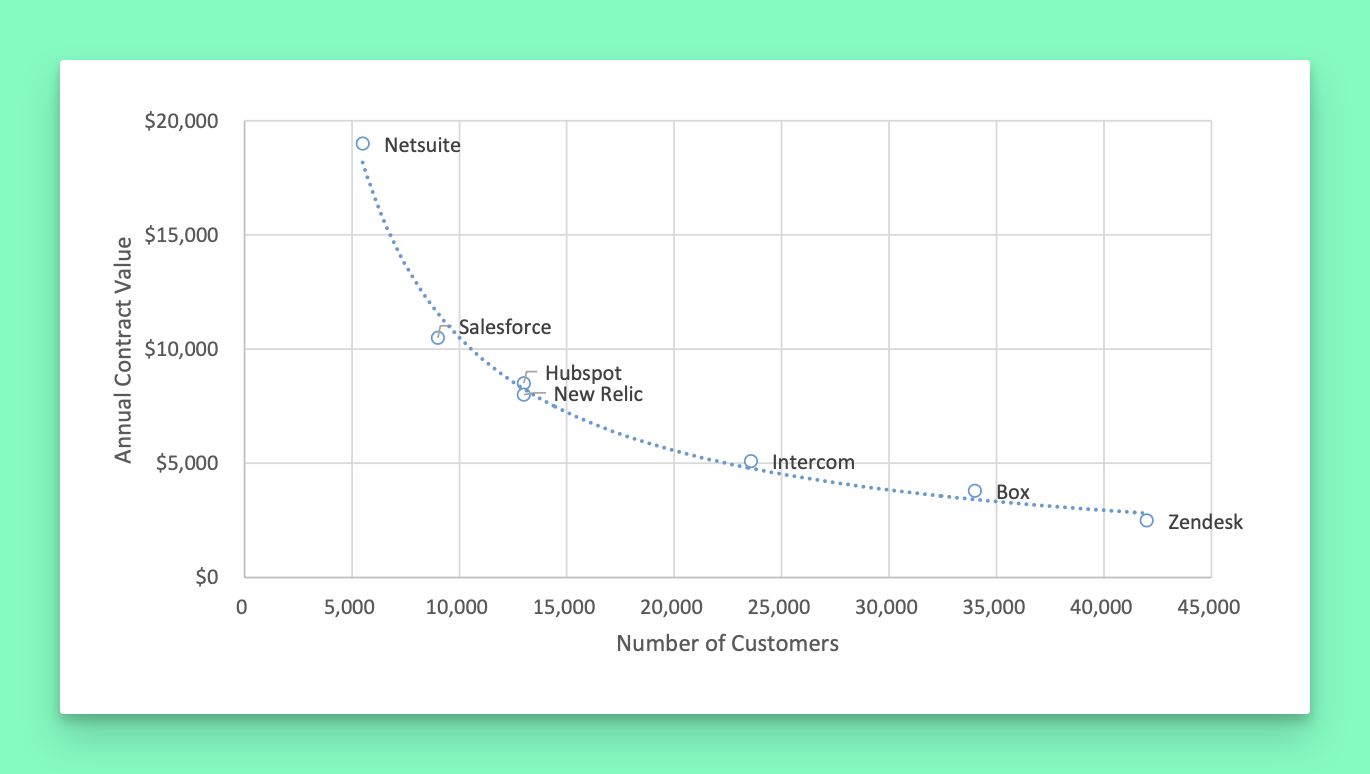

For example, in the early Intercom days, we’d have a slide in our investor data deck that showed what we believed our customer count and ACVs looked like relative to our peers. This helped give credibility to our $100M ARR forecast and opened a conversation about how we were similar to and different from those peers. The more you can do this across all your metrics, the better.

Hopefully now you feel more prepared to enjoy the chaos that comes with fundraising. Yes, it’s high stakes. Yes, it’s intense. But it should also be fun.

Finally, if you ever need help setting up key metrics for your data deck, Equals Experts can help. We have decades of experience putting together materials for our own fundraising processes, and we’d love to help you, too.