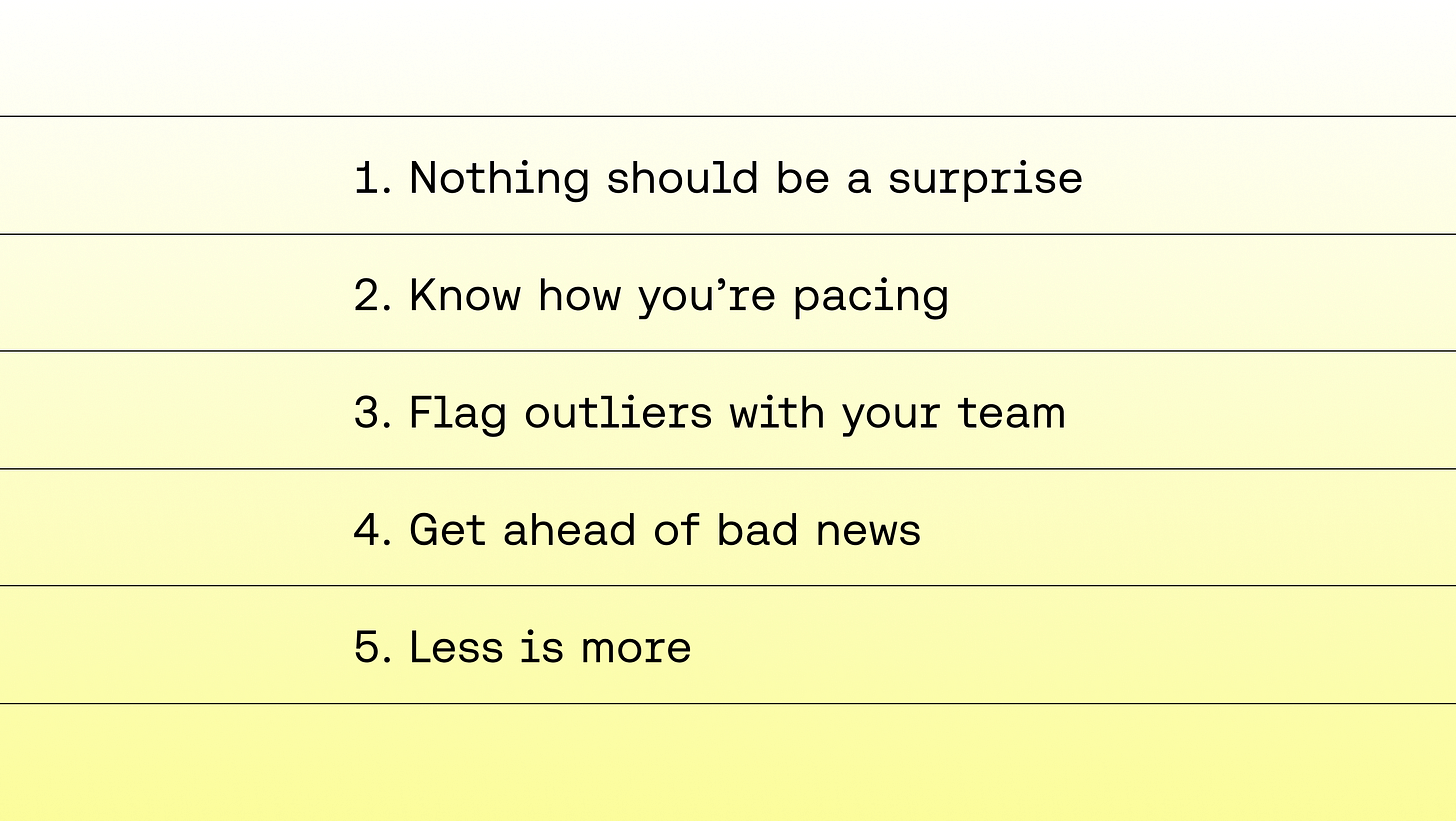

Your board meeting shouldn’t be a final exam

These five simple steps will help you avoid those painful last-minute cram sessions ahead of your next board meeting.

Board meetings are always stressful, and justifiably so. You’re sharing the most important updates with your most important stakeholders. It’s natural that you feel pressure to craft the perfect narrative on the businesses’ performance and vision for the future.

Board meetings are also highly regular. But for some reason, they always sneak up on you. The voice in your head frantically asks… How did three months go by so quickly? What updates are owed from the last meeting? How has our outlook for the future changed? Does my view line up with everyone else's?

Flashbacks to cramming for a final exam at the eleventh hour inevitably follow. The pressure of the meeting will, and should, always be there, but there are steps you can take to reduce those moments of pure panic.

1. Nothing should be a surprise

It sounds obvious, but the most important thing to do is continuously monitor each metric you present in the Board meeting. Every chart, table, and data point you share in a board deck should be automatically updated between meetings. The more regular, the better. Don’t wait for a standing weekly or monthly review to check-in.

We recommend daily checks on things like website visits, trial starts, new customers, Net New ARR, and Cash Burn. Yes, there will be noise depending on the day of the week, but you’ll start to develop an intuition about baseline performance.

Other metrics, like cohort performance and retention, might require a longer time horizon, but even monthly checks on these are better than waiting until the end of the quarter to review.

2. Know how you’re pacing

Take the extra steps to compare absolute performance against the plan or forecast shared with the board. Invest the time in understanding how each metric historically builds throughout the quarter, keeping in mind your business's unique dynamics.

If you're a sales-led business, ARR contribution might be back-weighted ~50% or more to the last month of the quarter. And if you’re a PLG business, top-of-funnel metrics like website visits and trials might be more vulnerable to seasonality or inflated following a product launch.

We recommend understanding the slope of your forecast build and comparing that to actuals as frequently as possible. If set up correctly in a dashboard, this should take ~5 minutes of your morning.

3. Flag outliers with your team

Keeping a close eye on performance takes discipline, and life at a startup of any size is full of distractions. Leaders responsible for these metrics will appreciate having a sanity check if things look off. It also gives them time to course correct before a trend becomes a painful problem.

So, once you’ve established a cadence for checking performance, look for outliers and flag them with your team. Don’t go overboard and start fires for the sake of wanting one to put out. Just remember that Finance is the last line of defense in performance monitoring. Threading this needle correctly can help the business become more proactive, and your team earn trust throughout the company.

4. Get ahead of bad news

Despite your best efforts in alerting and monitoring, you will inevitably reach a point where you miss targets. It eventually happens to everyone. How you handle these more delicate moments really matters.

"Try to anticipate if any news you're sharing is going to be controversial and try to communicate ahead of sending out board materials."

- Anonymous, SVP Finance at a real Series B company

Don’t wait for the board meeting. Be proactive and share the news ahead of it. How you share it depends on the size and severity of the news. More serious cases should be dealt with in a conversation, while smaller matters can be handled with a quick email.

I can’t stress enough that the worst place for your Board to learn about bad news is in the board meeting. Work with your CEO to get ahead of it. Your Board will feel more informed, and you’ll build trust with them as a result.

5. Less is more

No one gets graded on the number of slides they share, but we all have a story of a “quick update” that suddenly became a 100+ page deck. While most set out with good intentions, sharing too much information is problematic for a number of reasons.

"The risk of including more data means wasted time preparing materials and getting side-tracked during the meeting with unproductive questions or follow-up requests."

- Anonymous, VP Finance at a real Series B company

It’s difficult for board members to see the signal through the noise. Remember, they’re not living in your business every day. Your job is to make their job easier by focusing their attention on what matters most. A simple rule of thumb is that if you’re not actively managing the metric, don’t bother showing it.

Know the material, present it clearly, and be efficient with your time. Everyone will appreciate you for it.

Always be prepared to go one or two clicks deeper, but lead with the headlines.

I’ll leave you with some additional advice CFOs and Finance leaders shared with me:

“When you’re in the early stages (Seed or early-Series A), I try to keep it focused on two things 1) Net Burn/Cashflow and 2) Revenue Growth. I emphasize that these are by far the most important things.”

“Always stay neutral with your board. When the business is performing well, don't flaunt it. When the business is underperforming, don't overreact. All boards care about is if you're confident and the best way to show that is by showing up the same way every time.”

“Try to cover bad news earlier - in my experience board members and meetings only get contentious when a board member thinks that you are not aware or appropriately worried about a given issue. If you lead with "this didn't go as expected, here's what we're doing" rarely is there a confrontation.”

Good luck next quarter. 😉