An analyst's quest to improve retention for HubSpot CRM

When you uncover who your best-fit customers are, I say go all-in.

A few weeks after launching The Ultimate Guide to ARR, I received a note from Mark Znutas, former VP of GTM Operations and Strategy at Hubspot.

Immediately after reading this email, I knew Mark and I would become friends. We jumped on a call, and one of the first things he told me was that “ARR reporting changed his career.”

Same for me.

I asked Mark to share his story with the world in the hopes that we can continue to share our experiences and help founders and operators maximize their businesses' potential.

Over to Mark.

HubSpot’s CRM product is a behemoth. It’s a multi-hundred-million dollar Annual Recurring Revenue (ARR) business line with hundreds of thousands of users. But it wasn’t always that way.

In the early days, there were existential concerns about the product's viability. Weak net dollar retention (NDR) made everyone wonder whether HubSpot could successfully transition from an “inbound marketing app” to a CRM platform. Winning in the CRM market was far from a foregone conclusion. And that’s where my story and the HubSpot CRM story intersect.

I was an Operations Analyst at the time - one of dozens of analysts at HubSpot who struggled to stand out in the crowd. Through one of the luckiest breaks in my career, I was asked to join the team building the HubSpot CRM.

Obviously, I knew I should spend my time thinking about improving net dollar retention, but I didn’t know where to start. How does one just fix NDR? Surely someone smarter than me would have already done it if the solution were straightforward, right?

As I ventured out to solve the retention problem, inputs came from everywhere.

I read generic articles on the internet about how to fix retention in a subscription business. Unsurprisingly, those articles gave generic advice that wasn’t helpful.

I talked to customers. Customers were much more insightful than the internet, but I struggled to find macro-level insights from these micro-level conversations.

I talked to the rest of the CRM team. Everyone had a perspective on how to improve retention, but this input felt more anecdotal than data-driven.

I was gathering more and more information with little insight to show for it.

Ironically, the approach I was looking for came when I wasn’t searching for it. It hit me when I was doing our regular monthly reporting for the CRM product line – one of my recurring responsibilities at the time.

“The Customer File”

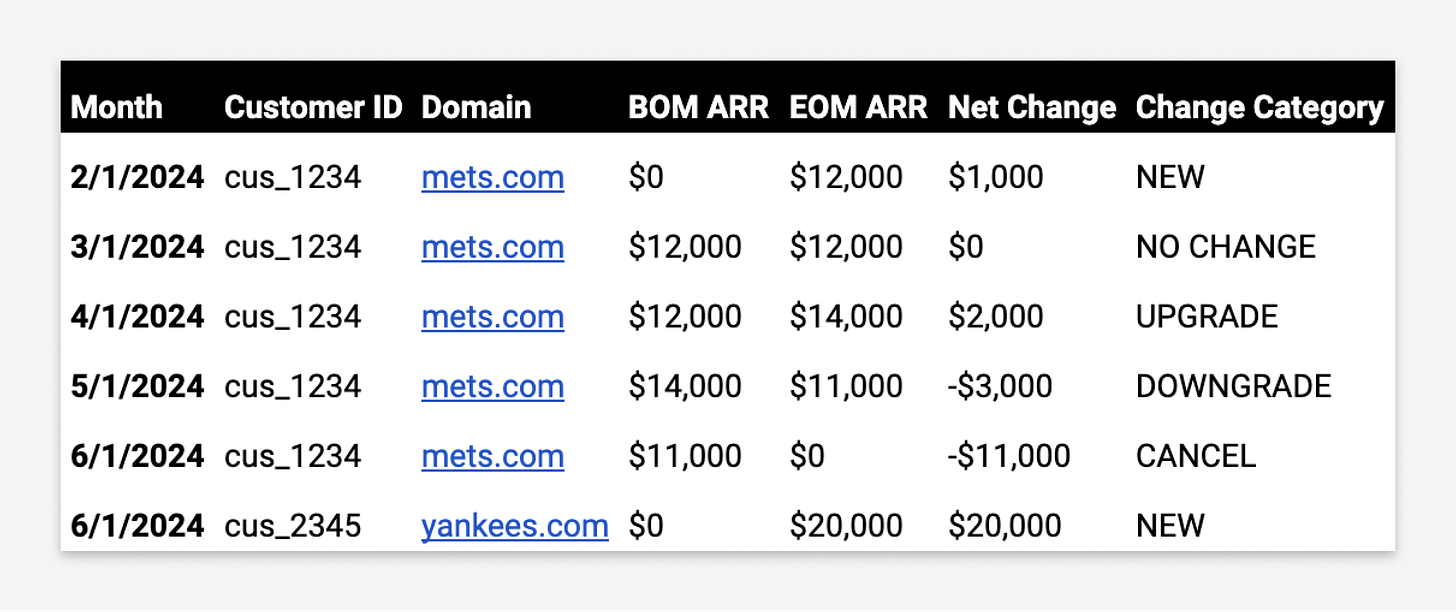

The basis of nearly all of our reporting was a large table called The Customer File. It contained Stripe billing data we pulled for all our customers, aggregated by month, and calculated the beginning-of-month ARR, end-of-month ARR, net ARR change, and change category for each customer.

Below is an example of what that table looked like:

This simple table enabled us to answer a ton of questions about the business, including:

How much net new ARR did we add last month?

How fast is new ARR growing year-over-year?

What’s net dollar retention?

What’s the upgrade rate?

How many customers did we add last month?

What’s logo retention?

How does the average ARR per customer change over time?

As an analyst, I couldn’t do my job without it. The Customer File was an insight cheat code, but I also realized it had the potential to be much more than it was. In its initial form, it helped me understand the “what” but didn’t help me understand the “why.”

I started to believe the answer to our retention problem could be found somewhere in the customer file. My hypothesis was that, like any early-stage venture, we hadn’t found product-market fit with all customers, but we did have it with some customers.

To test this, I wanted to answer a simple question: are there segments of the customer base that retain significantly better or worse than the average?

The “Wide” Customer File

I cut retention by every dimension I could think of to see if I could find any insight into retention. Those dimensions included firmographic data, product usage data, lead source data, Sales & CS ownership data, and many others. I added new columns for every question I wanted to answer, like:

Do companies with specific employee sizes retain better than average?

Do companies in certain countries retain better than average?

Do certain industries retain better than average?

Does the channel where the lead was sourced from impact retention?

Does the number of Monthly Active Users correlate to retention?

Do existing Marketing Hub customers retain better than average?

Does the AE who sold the deal impact retention?

Does the CSM who is working with the customer impact retention?

I had dozens of questions (and corresponding columns). The “wide” version of The Customer File started to look like this:

It made answering my questions a breeze. The output was a series of tables with the number of customers, ARR, New ARR, Net Dollar Retention, and Logo Retention cut by different segments. They looked like the table below (using employee size as an example):

Output to insight

After producing dozens of these output tables, I finally found the insight I had been searching for. There were two variables with clear and strong correlation to retention:

Employee Size → Companies with 10 or fewer employees were rough

Whether the CRM customer also used HubSpot Marketing Hub → ”Platform” customers were great

This analysis made us realize our customer acquisition strategy wasn’t right. We were disproportionately acquiring very small businesses even though those customers had weak retention profiles relative to the rest of the customer base.

Insight to action

Now, it was time to put our insight into action. We went all in on focusing on our best-fit customers.

We started by focusing on acquiring more “Tier 1” customers (companies with 11+ employees or HubSpot Marketing Hub) and fewer “Tier 2” customers (companies with 1-10 employees and no HubSpot Marketing Hub).

The marketing team divested from paid ads in channels like Facebook, which yielded mostly Tier 2 customers. We changed the Sales team’s commission plan to pay twice the commission rate on ARR from Tier 1 customers relative to ARR from Tier 2 customers. Finally, the Customer Success Team would allocate more time and resources to Tier 1 customers. Because, retention.

Action to impact

We rolled out these changes and were eager to see results. But the challenge with retention is that it takes a long time to move—it’s a highly lagging metric. So, we used net dollar retention heatmaps to measure whether net dollar retention for newer cohorts was improving month over month. We believed adding a healthier mix of new customers was our biggest lever to improve retention.

Good news—it worked! Retention in newer cohorts improved materially, slowly increasing the overall net dollar retention numbers. Net dollar retention improved by over 15 points within the next six months. And we didn’t have to make material investments to drive these gains. We just learned who our best-fit customers were and focused on acquiring more of them – from Marketing to Sales to Customer Success.

Was our analysis the magic bullet that fixed retention? No, definitely not. We had an amazing product and an amazing group of people building it. But identifying our good-fit customers definitely helped.

"We just learned who our best-fit customers were and focused on acquiring more of them – from Marketing to Sales to Customer Success." Love the focus on the fundamentals Mark Znutas.

adding the proverbial two-cents....

Three fastest ways to grow revenue:

1) Improve pricing

2) Acquire more of your best-fit customers

3) Funnel more deals to your best reps.

Finding your best customers is the key. The next step is understanding the product mix (this will influence product & pricing strategy so you can improve pricing) & the right sales motion (Freemium to premium, 7-day premium tease/trial to base, bundle discount etc) that causes them to enjoy your product so much they become your best customers.

It all starts with an ARR Table that most companies can't build. Glad Equal is solving this. ARR tables provide visibility into GRR & NRR drivers which are required to find your best-fit customers.