Why Sales and Finance can't agree on ARR

When you can't see eye to eye on performance, here's how to bridge the gap.

Every quarter, I witness the same scene play out: the CFO says we're way behind target while the CRO insists we're about to crush our number. The rest of the leadership team is left wondering, "What are we supposed to do with this?"

Sound familiar?

The frustrating reality is both teams are probably right—they're just looking at different metrics.

Sales are focused on bookings (when deals are signed), while Finance tracks billings (when customers are invoiced).

This disconnect might seem academic, especially when juggling a million other priorities, but ignoring it creates real problems that compound over time.

When two teams aren't seeing eye to eye on performance, how do you bridge the ARR gap?

Here’s what I've learned from helping dozens of companies bridge this gap so you don't have to learn it the hard way.

Why you should act now

The consequences of not addressing this disconnect between Sales and Finance early are threefold:

1. Missed opportunities for intervention

If you're halfway through the quarter and Sales feels confident while Finance is nervous, there are things you can do to course correct. But nothing will actually change if half your organization thinks everything's fine. This misalignment could stem from underperforming self-serve revenue, timing differences in recognition, or varying subscription start dates.

2. Last-minute reconciliation chaos

Many teams save all their reconciliation work for quarter-end. This means doing manual checks in an already high-pressure environment. It's bad enough not knowing if you're on track halfway through the quarter—it's even worse being a week past quarter-end and still uncertain if you hit your number.

3. Strained team relationships:

These disconnects create unnecessary tension between teams. I've seen too many meetings devolve into "my opinion versus yours" debates, which do nothing but erode trust and collaboration.

Understanding the disconnect

The fundamental challenge is that bookings and billings track different moments in time, and a lot can happen between them. Here's how to think about each:

Bookings

This is typically when a contract is signed. Sales tracks this out of the CRM, their canonical source of truth, and is typically how they are compensated.

Billings

This is tracked via subscription events or invoices from systems like Stripe. Similar to CRM data for Sales, Finance is typically tracking against billings because this corresponds to Revenue and cash collections.

The gap between these events can be thought of in three main categories:

1. Timing differences

Sales deals are like gravity: no matter how hard you try to fight it, there’s a universal pull to close on the last week or day of the quarter.

While contracts often manage to get signed on the very last day of the quarter, the corresponding subscription typically starts a few days into the next quarter.

This results in Sales counting it this quarter but Finance counting it next quarter.

This problem stacks on itself when you consider that the same issue from prior quarters is also present: deals that Sales closed last quarter are being billed this quarter in Finance’s numbers. Said another way, this customer will create a similar discrepancy when aligning on Q2 performance, but this time, it will appear in Finance’s new customer list but not Sales. Some enterprise businesses may even have deals that are closed several quarters ahead of the time they’re invoiced, which creates an even longer gap between billings and bookings recognition.

As a side note, we were able to avoid some of the confusion related to these timing discrepancies by introducing the concept of a grace period —allowing deals signed within a certain window of quarter-end to count in the current period. It’s more work to track and reconcile, but it went a long way in helping the various teams get aligned.

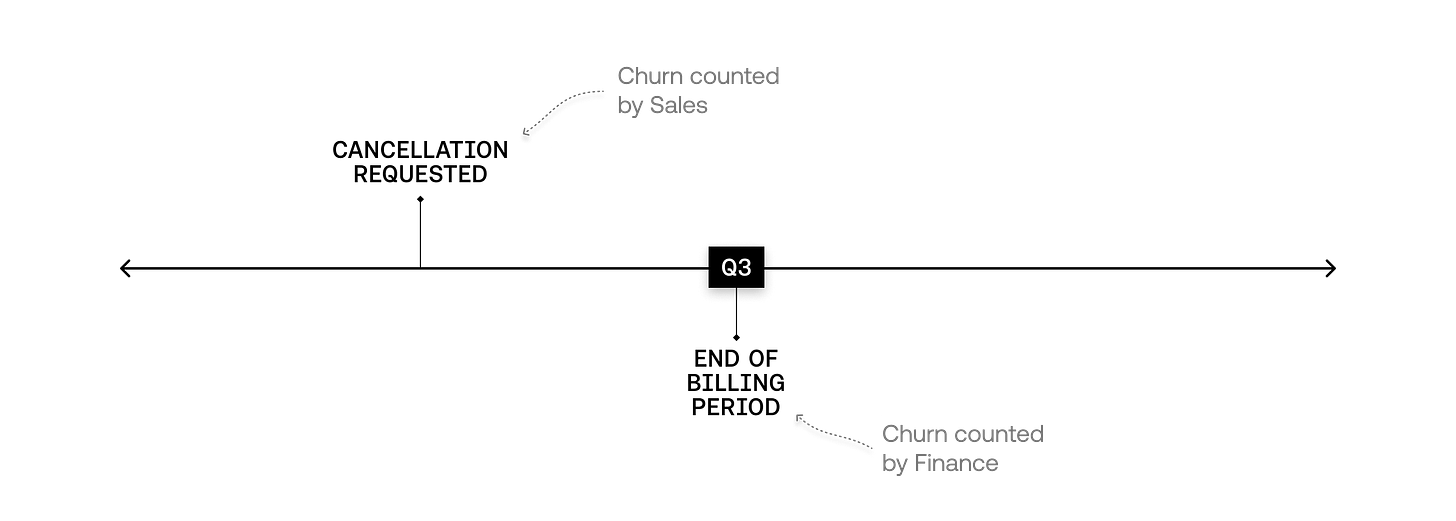

A separate but related issue can also present itself when considering cancellations or lost renewals. The date the Sales team recognizes the churn might be when the cancellation was requested. In contrast, Finance typically counts this at the end of the billing period to align with Rev Rec (revenue recognition).

2. Incomplete CRM data

The next set of discrepancies come from events typically executed out of the billing system and don’t make their way to the CRM where Sales track bookings.

Here are a few examples I’ve seen from my time at Intercom and Equals:

Business unit measurement

Finance typically measures performance at a global level, but if your business has a Self-Serve or PLG motion, it is typically not tracked by Sales. Surprises around how this business unit is performing can lead to different perspectives on overall performance.

Missing deals

Even though Sales reps are compensated based on data in the CRM, deals can still slip through the cracks.

This can happen because an opportunity is stuck in deal desk review or the deal owner left the company or transferred to a new role. Some deals also include auto-escalations in pricing from Year 1 to Year 2, which isn’t always tracked in a new opportunity.

Billing-initiated changes

This last set of discrepancies is a catch-all of operational changes that Sales is often not aware of, including:

Moving a customer to a different pricing model to unlock specific product functionality

Pricing migrations or graduations from a starter to a more permanent plan

Coupons expiring, especially those for introductory pricing “[x%] off your first 3 months”

Payment relief for companies experiencing cash flow issues

3. Mismatching values

Here, Finance and Sales agree on the deals to evaluate, but the amounts vary.

The variance here typically stems from billings initiated outside of contracted spend, such as fluctuations in spend from monthly (M2M) customers or if overages, usage over contracted maximums, are permitted without speaking to Sales.

Here are a few examples:

Measuring uplift for converting M2M customers onto annual contracts → do you count the full contracted amount or just the uplift from the annualized M2M spend vs. contracted Annual Recurring Revenue (ARR)?

Overages → Some companies allow customers to self-serve (i.e., buy without engaging with sales) additional seats or product SKUs without needing to sign an amended contract, which may not be sent back to the CRM.

CRM deal details do not match what’s provisioned in the billing system → if this process is not automated, this could be as simple as fat-fingering a value incorrectly in the CRM or Stripe.

To be clear, not all of these things need to be tracked in the CRM, but knowing the potential points of discrepancy is essential.

Building your first bridge

The solution to ARR discrepancies is creating a systematic way to compare your entire customer base across both systems. Here's how to get started:

1. Establish your ARR methodology

Before you can bridge anything, you need a clear definition of how you calculate ARR down to the customer level. This provides the foundation for all other reconciliations.

2. Pull comprehensive lists from both sources

Generate the complete list of customers contributing to both billings and bookings in the period. At a minimum, you’ll need to include the customer names, IDs, amounts, and effective dates between both lists. It may also make sense to include other dimensions your business forecasts against, such as segment, territory, or business unit.

3. Create unique identifiers to join between lists

This simple step is often overlooked. To reliably compare customers between your billing system (e.g., Stripe) and CRM (e.g., Salesforce), you’ll need a matching ID key in both systems.

4. Look for variances

Compare the lists, categorize variances into distinct buckets, and identify the root cause of each discrepancy bucket.

Below is an example of categorizing the discrepancies at an aggregate level. I like having a visualization like this to make it clear where the biggest variances are coming from. This also helps prioritize where to spend your time when digging deeper and proposing fixes to systematic issues

5. Review regularly

Don't wait until quarter-end. Make this a weekly exercise to catch issues early and help leaders bridge between the different signals in their forecasts. Equals makes this easy by automatically distributing your Sales and RevOps dashboards to your team in Slack or email weekly.

Build your bridge to predictability

While this might feel like extra work, especially early on, it's an investment that pays dividends in reduced stress and better forecasting. Finance teams often get stuck in reactive mode, reporting what happened in the past. This bridge helps you become a proactive partner in steering the business.

Remember: Preparing for your board meeting or investor update shouldn't be the first time you're reconciling these numbers. Build this muscle early, and you'll thank yourself later.

Need help building your ARR bridge? We've built bridges at Intercom, Stripe, and Atlassian, to name a few, and we would love to help you. Let's chat.