Why we changed pricing 3 times in 1 year

When the perfect pricing model doesn't exist, you must experiment to find pricing-market fit.

Pricing is a crucial lever in growing a SaaS business. Get it right, and it can dramatically accelerate your trajectory. Get it wrong, and it can stall your progress, preventing you from reaching your full potential.

I wish I could say it’s easy, but it’s not. There’s no silver bullet. You must test many things to find what works best for your product, at your stage, in your market. The challenge: the bigger you become and the more customers you have, the harder it gets to make changes to pricing. It only gets more painful the longer you wait.

If we've learned anything from our experiences at Intercom, Loom, and Equals, you have to be proactive in experimenting with pricing in order to find PMF.

Finding pricing-market fit

You’re probably familiar with finding product-market fit and know pricing is a key ingredient. It’s why, as we’ve evolved our product and our positioning, we’ve also evolved our pricing.

Equals is three years young and on its sixth version of pricing—yes, sixth. The last three versions were all tested within the last 12 months. With “Pricing v6”, we’re confident that we’ve found pricing-market fit–for the product we have today.

In this post we’ll break down exactly how we got here–every model, soup to nuts. But first, here’s a summary of what’s most important–what we’ve learned along the way.

Some of these seem obvious in hindsight, but hindsight is 20/20, and just because something worked/didn’t work in the past doesn't mean it will/won’t work in the future. So, remember to keep an open mind.

Usage limits harmed adoption

Limits (AKA ceilings) are very common in SaaS pricing as a means to drive upgrades to higher tiers. I’ve seen them prove very effective in the past, particularly at Loom when we introduced a limit on the length of recordings on the free plan. But for Equals, whether it was limiting how many queries you could run or the number of rows a query could return, it didn’t matter. These usage limits harmed adoption and probably caused churn, particularly because there was no rollover into overages. We forced you to the next tier instead. There are no usage limits in our latest pricing model. Everyone gets and can use all of Equals–as much as they like.

People didn’t like having to buy things they didn’t need (yet)

We experimented multiple times with bundling a fixed number of seats into the starting price to increase Annual Contract Values (ACVs). While people were willing to buy at higher prices, they did not like having to buy seats they did not yet need. We had to do this because the pricing models were not aligned with the value delivered. Once we understood and updated our model to align better with value (pricing primarily based on connected datasources), we no longer had to force people to start with a fixed number of seats. They can start with 1 or 20–it’s completely up to them.

Bigger swings resulted in bigger learnings

You learn the most from divergent experiments. We’ve experienced this first-hand. Whether it was killing freemium or turning off our self-serve business. It was from these “map jumps” that we learned the most. So, don't try tweaking your pricing by 20%. While that may work for established companies, for early-stage companies who haven't worked it out, you'll learn a lot more by trying wildly different things, e.g., 10x prices, changing the packaging structure, etc. Go big or go home.

Distribution was more important than maximization

We tried to maximize price points too early. Instead, we should have optimized for increasing deal volume and quality. You can always increase prices later as long as you're doing so on a foundation of highly satisfied customers and product that gets more valuable with time and use. It’s why we’re so focused on shipping frequently.

The pricing models

v1 → v2: Going freemium

This is what the first version of Equals’ pricing model looked like–a classic tier-based approach to packaging with seat-based pricing. Pretty simple stuff, albeit a relatively high barrier to get started at $250/mo.

Fast-forward to our Series A raise, we felt the product was ready for the masses, so we introduced a free plan and adjusted the existing seat-based pricing on paid plans.

Pricing v2 worked until it didn’t. Freemium tanked our business.

v3: Killing freemium and increasing ACVs

Six months later, we decided to experiment with killing freemium, which was a surprising success (see Bobby’s post for a deep dive into that infamous decision). 😅

Yet, while removing our free plan led to accelerated revenue growth (again), we were still struggling to close deals at the ACVs we felt we could command based on the value we knew our product was delivering to customers.

To enable sales to close bigger deals (selling the same product), we reduced the set of Connectors (e.g. Postgres, Stripe) included in the base price and started charging for additional connectors at $100/mo per connection. That helped, but at the same time, we started to learn that we were unintentionally limiting the willingness to pay of our most valuable leads.

How? Leads needing the top tier (Enterprise) were anchored on the middle tier's $149/mo price point (Professional), artificially limiting what they would pay for the best version of Equals. This was also a problem with Pricing v2; we just didn’t realize it at the time.

v4: Further increase ACVs

Pricing v4 included a bunch of tweaks, all aimed at:

Making our top tier more compelling, giving sales more to sell, and encouraging more leads to talk to us to get started

Anchoring leads that wanted the best version of Equals at a higher price point

Specifically, those changes included:

Renaming plans:

Starter → Good

Professional → Better

Enterprise → Best

Introducing a list price for the Best plan:

$499/mo billed annually, 5 seats included, additional seats $49/mo

No month-to-month option

Increasing the additional seat price on the Better plan

Introducing a Queries limit on Better – previously unlimited, now 500/queries/mo

Introducing a new Rows returned limit:

Good → 50k

Better → 100k

Best → 200k

Why did we want people to talk to us to get started?

Not all friction is bad. We continued to see that our best customers (based on product engagement and spend) were those who engaged with us before they started using the product. Equals is big, broad, and flexible, so it should be no surprise that people are more successful when we work directly with them to better understand the problems they’re trying to solve and get them set up with Equals to solve them.

Why did we change the names of the plans?

I've worked on more pricing projects than I can count. One thing that is always a point of contention is naming–"What do we call the plans?".

Starter | Plus | Pro | Premium | Professional | Business | Enterprise | Bananas.

I've seen it all.

So, when the opportunity arose to experiment with Equals’ pricing, I thought, "Fuck it, why don't we just call them what they are?".

Good | Better | Best

Much better.

Why introduce usage limits?

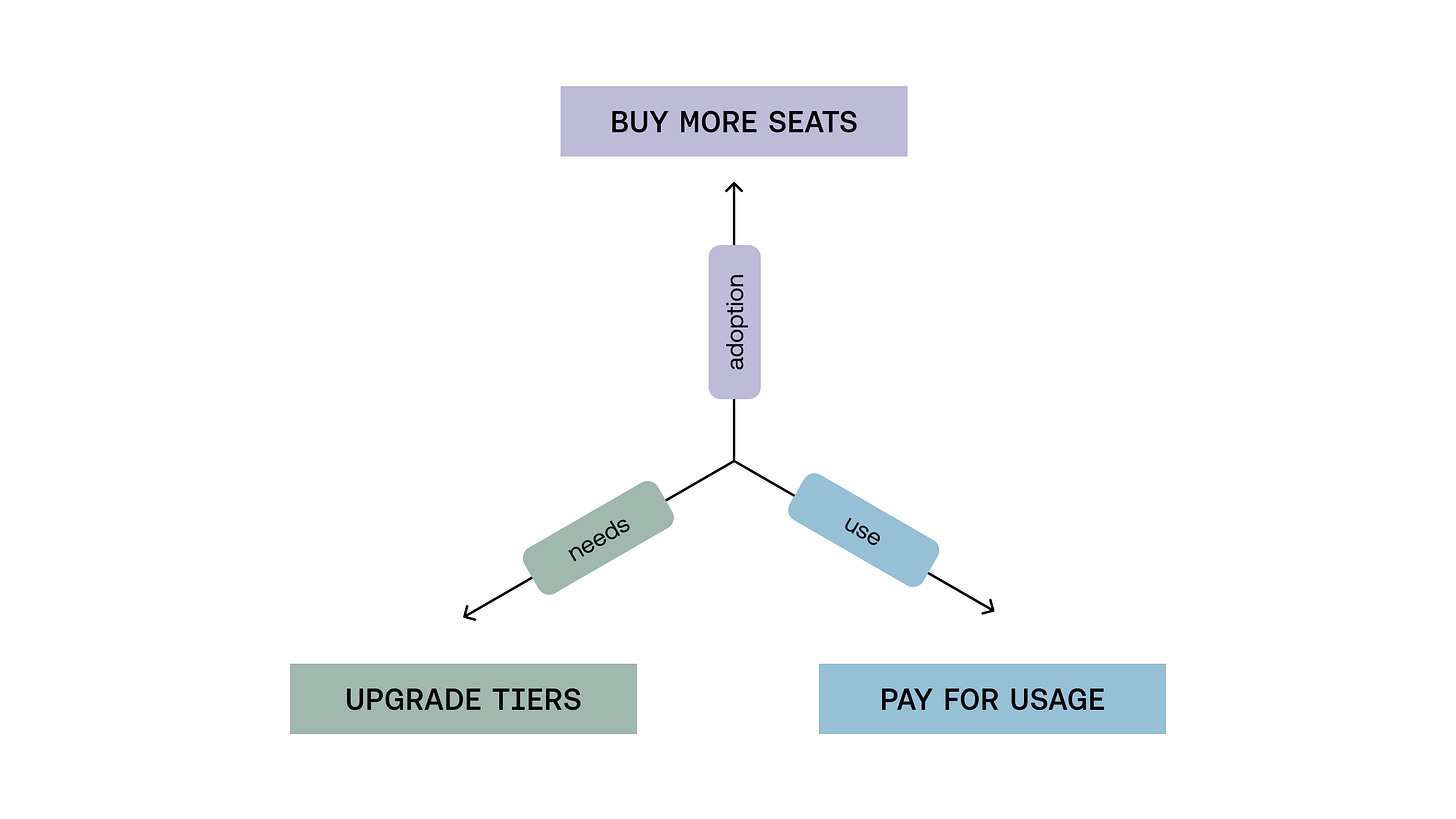

With tier-based and seat-based pricing, we had two ways for customers to increase their spend (i.e., expand), but we were missing a third: usage-based pricing.

By introducing limits on queries run and rows returned from a query, even if a customer didn’t grow (doesn’t need more seats) and its needs remained the same (doesn’t need a higher tier), they’d pay more the more they used Equals.

v5: Doubling down on “sales-only”

After seeing our sales business continue to grow and outperform our self-serve business, we introduced Pricing v5 to encourage even more leads down the “sales-only” path to get started. The goal was to further increase new customer ACV. This version of pricing had a 3x higher entry point and a 50% higher top-end price.

This was a significant set of changes, including:

Removing the middle tier to reduce complexity and improve differentiation between self-serve and sales-only paths to purchase.

No more query limit - everyone gets unlimited queries, providing a much better product experience.

Rows returned per query limit replaced with Rows per sheet to drive leads wanting to work with larger datasets to talk to sales.

New categories of connectors to better align price to value: Standard (included), Premium (+$100/mo/connection), Enterprise (only available on Better, starting at $500/mo/connection).

It’s worth noting that at about the same time, we introduced a new offering in Equals Experts–a team of analytics pros available on-tap to help with custom implementation, model building, and reporting automation. All subscriptions to our top tier included 10 hours of Equals Experts’ time. This ultimately formalized what we’d been offering to customers who engaged with sales, which was working well.

v6: Our simplest model yet

Pricing v6 is based primarily on the data sources you want to connect. There are no more tiers or limits. Its goal was to further increase ACVs and improve win rates.

Given there are no more usage limits or tiers, everyone gets to experience the full power of Equals, including the data explorer, full-featured spreadsheets, BI-grade dashboards, and AI Assist. All at a lower price per seat.

Pricing v6 represents the culmination of all our learnings from bringing Equals to market to date. And surprisingly, it’s our simplest pricing model yet. It’s designed primarily around two of our biggest learnings:

The number of connectors is a better value proxy than the number of seats

There are differing levels of willingness to pay for different connectors

These learnings really crystallized when we completely turned off our self-serve business and had all leads engage with us before they could use the product. We‘re bullish on this approach because we repeatedly see that when we onboard customers for a specific use case and connected data source, they’re far more successful and see value much more quickly. Will we turn self-serve on again one day? Maybe. 😉

Is it working? Yes. Is it perfect? No. It never will be. But it helped us find pricing-market fit.

If you take away one thing from reading this, I hope it’s that you realize you’ll never be done with pricing. As your product evolves, the market changes and your goals get more ambitious, your pricing must adapt. Don’t wait to pull your pricing lever. Act.

On that note, we wish you luck in your journey finding pricing-market fit.

Thanks for walking through all of this! Really cool to see the progression in detail.

I'm curious how you realized connectors were not only the best determinate for value, but also that willingness to pay differed among them? Was it based on intuition from talking to users and sales calls? Did you uncover in max diff survey?

And when figuring out each of these different version, did you launch each iteration of pricing as an a/b test?

Great post matt - how did you decide on that shift from self-seve startup focus to sales-led (smb/mid-market focus) ? Did you have them running always side-by-side or did you start with a sales - first Motion and was self-serve an experiment which didn't work out or bring enough conviction?